Beginning of the New Year is often a time when people have a sit down, look at their finances and make budget plans for the year ahead. This might include; savings for holidays, rainy day funds, renovations, motoring costs and of course facing the Christmas credit card bill hangover!

However, budgeting for motoring and car costs, can be tricky because some costs change up and down and vary for a whole host of reasons. For instance, changes to government “Ogden rate” from the Ministry of Justice back in March 2017, meant that over the course of 2017 insurance premiums went up for most drivers; especially younger drivers. And just to keep us all on our toes, the Government now look to be making a U-turn on that recently and there has been a lot of media coverage suggesting that car insurance premiums might be about to start coming down in price again over 2018. Which would be very welcome!

Something to bear in mind when you are budgeting for your car insurance, is that one of the most common claims made to insurance companies is for damage to windscreens (cracks, chips or complete failure). All policies vary, but a sensible option might be to look for a specific policy that offers windscreen cover without affecting your no-claims bonus and without requiring that you pay an additional excess. Insurance companies don’t always make this clear, so be sure to ask.

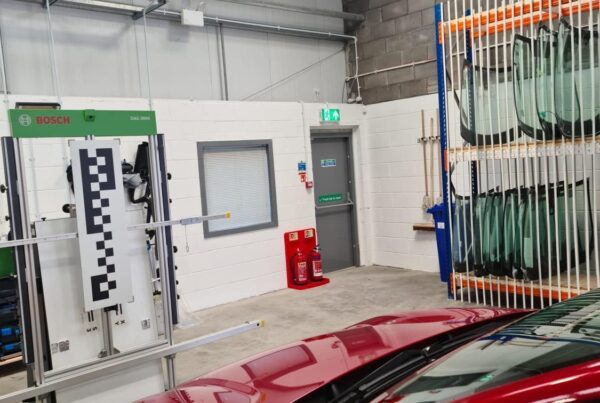

Strathclyde Windscreens have excellent relationships with most major insurers, so that provided you opt for Fully Comprehensive Cover we can deal with the damage and repair or replacement of your windscreen directly with your insurance company, saving you time and hassle. And if you have looked for cover that doesn’t require an excess payment for windscreens, then you will have the peace of mind of knowing that the most likely damage to your car, won’t cost you anything unexpectedly.

Which is less of a budgeting headache for you!